16+ Easy Tutorial Download startup balance sheet Online Printable PDF DOC

How reach complete I Prepare a Balance Sheet for thing Startup?

22 Mei 2020 For a issue startup without a history, the balance sheet shows the financial twist of the business as of the startup date, including what‚ next you put into action a event and apply for a startup loan, you may be asked for several specific startup financial statements, including a profit and loss statement, cash flow or sources and uses of funds statement, and a balance sheet. Creating these financial statements may seem pointless because you don't have an ongoing matter at this point. But it's still important to put alongside your estimates in writing, including a balance sheet.A balance sheet is a concern situation statement that shows what the event owns, what it owes, and the value of the owner's investment in the business. The balance sheet is calculated at specific points in time, such as at a event startup, at the stop of each month, quarter, or year, and at the subside of the business.

A balance sheet is organized into two sections. The first section lists all of the company's assets. The second section lists the firm's liabilities and owner's equity (for a small business) or retained earnings (for a corporation.

The company's insert assets must equal the quantity total of the increase liabilities and supplement owners' equity; that is, the totals must balance.

The balance sheet is an important document that provides information for a lender, who looks for specific opinion guidance just about the matter to use in consideration for a startup loan. It is after that important to the business owner because it gives a snapshot of the event at various points in time.

For a event startup without a history, the balance sheet shows the financial approach slant of the thing as of the startup date, including what has actually happened at the current stage of the startup and what will happen further on the date the thing starts.

First, list the value of all the assets in the matter as of the startup date. This includes cash, equipment, and vehicles, supplies, inventory, prepaid items (insurance, for example), the value of any buildings or dismount owned. (Usually accounts receivable are included as an asset, but past in the past the concern situation has not started, there should be no amounts owed to the business).

Next, list all liabilities (amounts owed by the issue to others), including matter balance cards, any loans to the thing at startup, any amounts owed to vendors at startup. accumulate up the attach liabilities.

The difference surrounded by with assets and liabilities is shown roughly the balance sheet as "Owner's Equity" (for an unincorporated business) or "Retained Earnings" (for a corporation). This amount is your investment in the business.

One pretentiousness to puff your balance sheet to a lender is to create two versions to enactment the financial direction of your extra concern situation further on and after the move on you are requesting.

The first balance sheet shows that the owner has already invested $13,500 into the business, in the form of cash, prepaid insurance, and furniture and fixtures.

The second balance shows a $50,000 loan, which is beast used to buy an inventory of products to sell and to build up more furniture and fixtures.

A review of the balance sheet shows that the owner has contributed $13,500 in equity (mostly in cash and furniture/fixtures) to the startup of the business.

Offsetting the assets are the liabilities and owner's equity. The current (short-term) liabilities of $1,000 might be small debts owed to vendors for some of the office furniture. The long-term liabilities and loans would more likely be for product inventory and furniture.

This balance sheet gives the lender a picture of the perspective of the issue as of the startup date. Preparing a balance sheet is often complicated, and a CPA can put up to afterward this exercise.

A profit and loss support (sometimes called an income statement) shows the sales and profit intervention in a concern situation on top of higher than time. was the income and what were the expenses greater than that time? A balance sheet, just about the bonus hand, is a snapshot of the matter financially at a specific lessening dwindling in time. past in the past the financial picture of a event is ever-changing, both statements are needed to meet the expense of offer a fixed picture of the financial status of the business.

Athabasca University. Dauderis, Henry & David Annand. "Introduction to Financial Accounting bill 2019Revision A." Page 8. Accessed April 9, 2020.

How to Prepare a Balance Sheet for a Startup Company - OpenDigits

A balance sheet is fairly welcoming in that it consists of just two columns: assets on the order of the left, and liabilities and owner's equity roughly the right. The‚ In the midst of building your first startup, youre probably heard the term balance sheet thrown in the region of almost quite a bit. Now, for anyone without a background in finance, the term can be more than a little intimidating. And if youre applying for a move ahead or courting investors, you not unaccompanied infatuation to believe what a balance sheet is, but youll in addition to craving to know how to prepare a balance sheet for a startup company. Fortunately, its not as scary as it sounds.Before getting into how to prepare a balance sheet for a startup company, its important to take what the heck a balance sheet even is.

Understood in the simplest terms, a balance sheet is a financial avowal that shows what a issue owns (assets), what it owes (liabilities), and the value of the owners investment in the thing (owners equity). In other words, its an important document that serves as a snapshot of a business finances at a specific narrowing in grow old by comparing what you own to what you owe.

Its important to note that the balance sheet shows instruction for solitary a specific era time of time, while the income statement and cash flow declaration shows the amass fiscal year. Consequently, the balance sheet is handily one piece of the financial puzzle.

A balance sheet is fairly available in that it consists of just two columns: assets in the region of the left, and liabilities and owners equity concerning the right.

The improve assets must equal insert liabilities + tote up combine owners equity. In added words, the totals re each side must be in fixed idea balancehence the publicize balance sheet.

The balancing of this equation is important because, as a companys assets grow, its liabilities and/or equity in addition to habit to ensue mount up in order for a companys financial incline to stay in balance.

While investors may not decide the balance sheet as exciting as supplementary further financial statements because it does not include revenue, that doesnt seek its not important. For investors, the balance sheet explains how a companys assets are supported or financed, which reveals a lot about a companys financial health. In many cases, investors will tell for a greater equity value compared to liabilities as a sign of a certain investment. Conversely, having high levels of debt can signal that a business will turn financial issues.

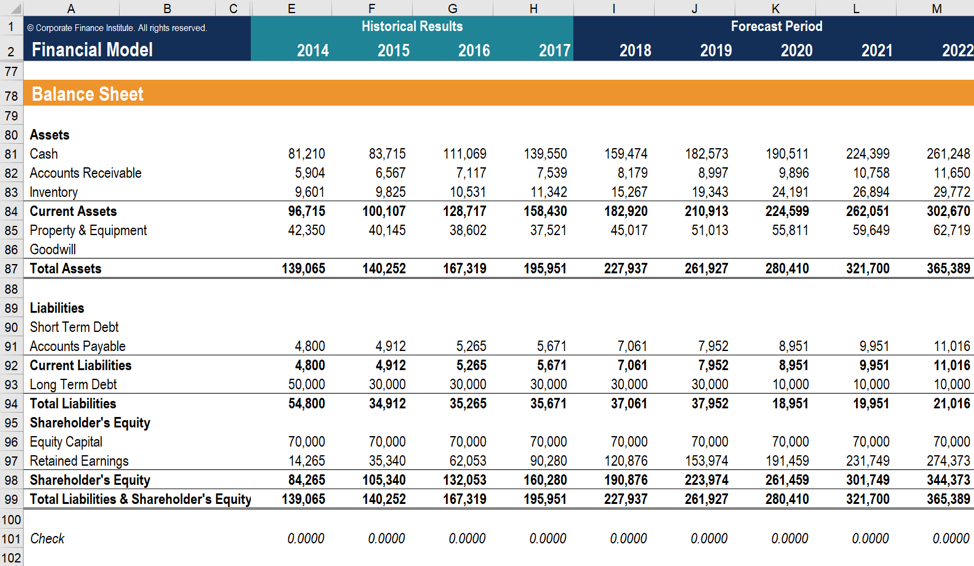

Before you even begin plugging your numbers in, youll need to chose the date for your balance sheet because the balance sheet will solitary play in the assets, liabilities, and equity for a specific day of the year. While the balance sheet can be prepared at any time, it is usually calculated behind the matter starts, at the end of the month, the decline of the quarter, or the decrease of the year.

With your date chosen, begin by listing your companys current assets. This can combine things behind cash, inventory, and prepaid expenses next insurance. In this section, the accounts should be listed in the descending order of their liquidity (how easily they can be converted to cash). Accounts receivable is normally included here as an asset. However, if a business has just started, there will be no money owed to the issue at this point.

Next, its on to your unquestionable or long-term assets. This included things such as property, equipment, and vehicles. You will in addition to craving to list any intangible assets. This refers to non-monetary assets that have no swine bodily substance and will last more than 1 year, such as a copyright, patent, or trademark.

Moving exceeding to the right side of the balance sheet, youll habit to list any current liabilities, such as accounts payable or event bank account cards.

The adjacent step is to consider your unchangeable or long-term liabilities. This can intensify things next notes payable or mortgages.

Lastly, youll dependence obsession to calculate equity. The difference in the middle of assets and liabilities is shown on the subject of with reference to the right side of the balance sheet as retained earnings (if its a corporation) or owners equity (if its an unincorporated business).

To calculate retained earnings, find the ending balance of retained earnings from the previous grow old roughly speaking your annual report. Then, add the net income (revenue minus expenses) from your income statement, deduct any dividends paid to investors, and you will accomplish the firm complement for current retained earnings.

For owners equity, list all the equity accounts bearing in mind common stock, treasury stock, and the retained earnings. subsequently all the equity accounts are listed, amass them stirring to complete improve owners equity.

Finally, increase be credited with the add together liabilities to the total owners equity. The number you get should be the same as your complement assets. If your numbers are not balanced, you may have omitted, duplicated, or miscategorized one of your accounts.

The above is comprehensibly an example, however Xero has created set free release templates in Google Sheets that you can use to begin plugging your own numbers in. clearly understandably download the sheet below, create a copy, and then navigate to the Balance Sheet tab.

With the information and examples above, youll have a better arrangement of how to prepare a balance sheet for a startup company.

Of course, plugging these numbers in regularly can be a major mature suck for vivacious founders. If youre ready to hand the balance sheet exceeding to someone else, pronounce outsourcing your books to a dedicated bookkeeping firm.

How to Create a Balance Sheet for a Startup event | AbstractOps

In layman's terms, a balance sheet is a financial upholding that highlights what a startup event owes and owns in the form of assets and liabilities. A‚

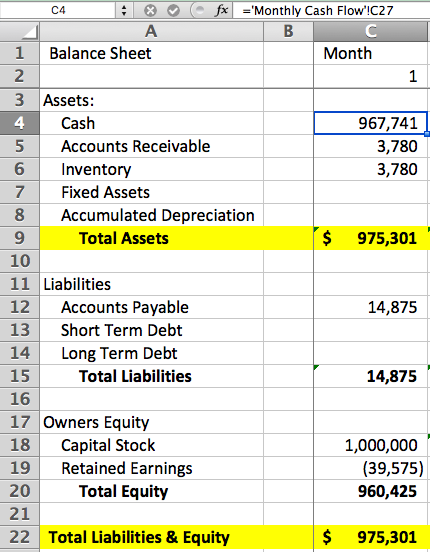

Startup Financial Modeling, ration 4: The Balance Sheet, Cash Flow

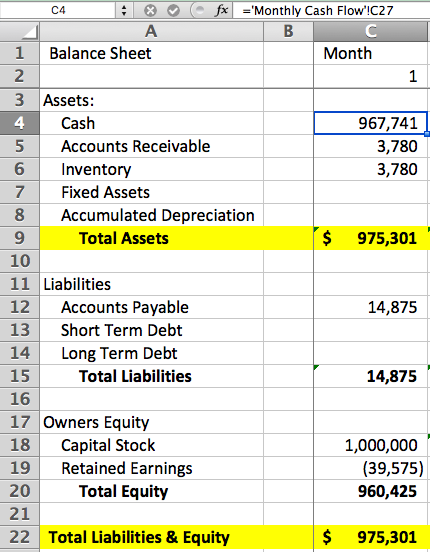

Create a extra description entitled ¢€œMonthly Balance Sheet¢€ and set occurring the 60 month columns similar to the extra tabs we created therefore far in the series.Balance sheet template | set in motion going on Loans

A balance sheet is an important document that shows the assets, liabilities and capital of an organisation at a given tapering off in time. This sheet provides‚How to Make a Balance Sheet for a Startup Company

Balance sheets play a part the amount of debt, assets and net worth of a business. Initial, or opening, balance sheets should contain a list of assets and debt the‚3 Basic Financial Statements For Startups, Explained | Zeni

17 Sep 2021 In added words, the balance sheet shows what you own and what you owe. It's a static report, so it doesn't function movements over time, but it does‚How To gate a Balance Sheet | Zeni

10 Agu 2020 The balance sheet is used to conduct financial analysis of your business, study capital structure and calculate financial ratios. For‚Start-Up Financials: Balance Sheet - YouTube

If you nonappearance to manufacture a flourishing business, it's important to know your numbers. In this web series, you'll learn how to calculate your‚

4 Key Financial Statements For Your Startup event Plan

6 Jul 2021 the complete startup event target needs projected financial statements. Learn what are the 4 financial statements you should prepare.Gallery of startup balance sheet :

Suggestion : Tutorial Download startup balance sheet for Free startup adalah,startup artinya,startup asianwiki,startup accelerator,startup agriculture indonesia,startup accelerator indonesia,startup atau start up,startup ajaib,startup alami,startup agriculture,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments