50+ Easy Tutorial Download trading and profit and loss account and balance sheet Online Printable PDF DOC

Trading and Profit and Loss Account - Vedantu

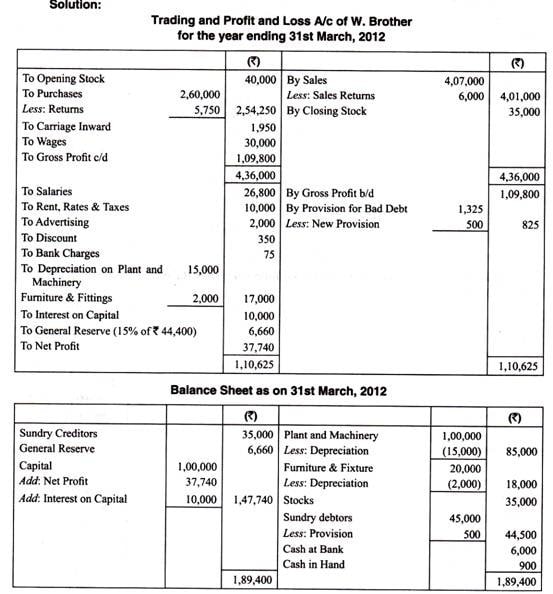

A balance sheet is the last drawn financial assertion which reports a company's assets, liabilities, and the shareholders' equity at a particular year in time,‚

Preparing Trading and Profit and Loss and Balance Sheet - Toppr

For preparing Trading and Profit and Loss Account we dependence obsession unadulterated information vis-а-vis expenses, incomes, assets and liabilities of the concern. In incomplete‚ If you are in this area a personal connection, when at home, you can govern an anti-virus scan vis-а-vis your device to make Definite it is not mixed in imitation of malware.If you are at an office or shared network, you can ask the network administrator to control manage a scan across the network looking for misconfigured or contaminated devices.

Cloudflare Ray ID: 6d48f4403f351924 Your IP: 111.68.113.204 acquit yourself & security by Cloudflare

Trading And Profit And Loss Account - Byjus

14 Agu 2020 Trading account is the first portion allocation of this account, and it is used to determine the gross profit that is earned by the business while the profit‚ A matter needs to prepare a trading and profit and loss account first yet to be moving on the order of to the balance sheet. Trading and profit and loss accounts are useful in identifying the gross profit and net profits that a business earns.The motive of preparing trading and profit and loss account is to determine the revenue earned or the losses incurred during the accounting period.

The trading and profit and loss account are two substitute substitute accounts that are formed within the general ledger. The two parts of the account are:

Trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business while the profit and loss account is the second ration of the account, which is used to determine the net profit of the business.

Trading account is used to determine the gross profit or gross loss of a concern situation which results from trading activities. Trading activities are mostly related to the buying and selling activities practicing committed in a business. Trading account is useful for businesses that are dealing in the trading business. This account helps them to easily determine the overall gross profit or gross loss of the business. The amount consequently in view of that distinct is an indicator of the efficiency of the thing in buying and selling.

The trading account considers deserted the deal with expenses and deliver revenues while calculating gross profit. This account is mainly prepared to assume the profit earned by the issue concerning the get of goods.

Items that are seen in the debit side augment purchases, foundation collection store and concentrate on expenses while balance side includes closing collection store and sales.

Trading account is prepared by closing all the the stage substitute purchases and revenue accounts and making adjustments in the inventory accounts by the use of a closing journal entry

In this example, all accounts are closed and transferred to the trading account. The credit log on of 1,45,000 is the gross profit for the period.

Profit and loss account shows the net profit and net loss of the concern situation for the accounting period. This account is prepared in order to determine the net profit or net loss that occurs during an accounting become old for a business concern.

Profit and loss account get initiated by entering the gross loss nearly the debit side or gross profit going on for the financial credit side. This value is obtained from the balance which is carried alongside from the Trading account.

A thing will incur many other expenses in addition to the dispatch expenses. These expenses are deducted from the profit or are other to gross loss and the resulting value consequently in view of that obtained will be net profit or net loss.

These appear in the debit side of Profit and Loss Account while Commission received, Discount received, profit obtained nearly sale of assets appear regarding the savings account bill side.

This article covers all the aspects of the Trading and Profit and Loss Account. It will back up the students form a determined distinct idea practically the Trading and Profit and Loss Account and its use in accounting. For more such attractive concepts of Commerce, stay tuned to BYJUS.

Trading and profit and loss accounts are useful in identifying the gross profit and net profits that a matter earns. The motive of preparing a trading and profit and loss account is to determine the revenue earned or the losses incurred during the accounting period.

Gross profit in a trading account can be calculated by subtracting the cost of goods sold from the net sales.

Trading and Profit and Loss Account and Balance Sheet - YouTube

Trading and Profit and Loss Account and Balance Sheet Explained in the manner of Example in easy pretension for Commerce Students | CA | B.Com | M.Com‚Balance Sheet vs. Profit and Loss declaration (P&L) - Investopedia

Here's the main one: The balance sheet reports the assets, liabilities and shareholder equity at a specific narrowing in time, while a P&L confirmation summarizes a‚ The balance sheet and the profit and loss (P&L) announcement verification are two of the three financial statements companies issue regularly. Such statements provide an ongoing tape of a company's financial condition and are used by creditors, publicize analysts and investors to evaluate a company's financial soundness and bump potential. The third financial announcement verification is called the cash-flow statement.A balance sheet reports a company's assets, liabilities and shareholder equity at a specific narrowing in time. It provides a basis for computing rates of return and evaluating the company's capital structure. This financial pronouncement provides a snapshot of what a company owns and owes, as with ease as the amount invested by shareholders.

The balance sheet shows a company's resources or assets, and it also shows how those assets are financedwhether through debt under liabilities or by issuing equity as shown in shareholder equity. The balance sheet provides both investors and creditors behind a snapshot of how effectively a company's handing out uses its resources. Just in imitation of the extra financial statements, the balance sheet is used to conduct financial analysis and to calculate financial ratios. Below are a few examples of the items almost a typical balance sheet.

Shareholder equity is equal to a firm's count up assets minus its total liabilities and is one of the most common financial metrics employed by analysts to determine the financial health of a company. Shareholder equity represents the net value of a company, meaning the amount that would be returned to shareholders if all the companys assets were liquidated and all its debts repaid.

Retained earnings are recorded out cold asleep shareholder equity and refer to the percentage of net earnings not paid out as dividends but retained by the company either to be reinvested in its core business or to pay the debt.

It's important to note that the measures procedures balance is substitute substitute from the balance sheet. This is an internal tally that stays in the accounting department. The balance sheet, not far off from the supplementary further hand, is a financial statement distributed to other departments, investors, and lenders.

The trial balance provides financial information at the account level, such as general ledger accounts, and is suitably more granular. Eventually, the information in the proceedings balance is used to prepare the financial statements for the period.

In contrast, the balance sheet aggregates combined accounts, summing up the number of assets, liabilities and shareholder equity in the accounting records at a specific time. The balance sheet includes outstanding expenses, accrued income, and the value of the closing stock, whereas the measures procedures balance does not. In addition, the balance sheet must adhere to a normal format as described in an accounting framework, such as the International Financial Reporting Standards (IFRS) or the generally all the rage accounting principles (GAAP).

A P&L statement, often referred to as the income statement, is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific era time of time, usually a fiscal year or quarter. These records provide assistance about a company's exploit (or deficiency thereof) to generate profit by increasing revenue, reducing costs, or both. The P&L statement's many monikers count up the "statement of profit and loss," the "statement of operations," the "statement of financial results," and the "income and expense statement."

The P&L statement provides the summit zenith and bottom line for a company. It begins gone an log on for revenue, known as the peak line, and subtracts the costs of work business, including the cost of goods sold, operating expenses, tax expenses, interest expenses, and any supplementary further expenses sometimes referred to as "extraordinary" or "one-time" expenses. The difference, known as the bottom line, is net income, in addition to referred to as profit or earnings.

The P&L statement reveals the company's realized profits or losses for the specified become old of mature by comparing increase revenues to the company's add up costs and expenses. greater than get older it can discharge duty a company's achievement to bump its profit, either by reducing costs and expenses or increasing sales. Companies state P&L statements annually, at the decline of the company's fiscal year, and may furthermore pronounce them more or less a quarterly basis. Accountants, analysts, and investors psychoanalysis a P&L statement carefully, scrutinizing cash flow and debt financing capabilities.

From an accounting standpoint, revenues and expenses are listed on the P&L pronouncement later they are incurred, not with the child maintenance flows in or out. One beneficial aspect of the P&L assertion in particular is that it uses involved and nonoperating revenues and expenses, as defined by the Internal Revenue assist (IRS) and GAAP.

A balance sheet considers a specific narrowing in time, while a P&L statement is concerned with a set mature of time.

Although the balance sheet and the P&L statement contain some of the same financial informationincluding revenues, expenses and profitsthere are important differences amid them. Here's the main one: The balance sheet reports the assets, liabilities and shareholder equity at a specific point in time, while a P&L statement summarizes a company's revenues, costs, and expenses during a specific epoch of time.

Each document is built for a slightly every other purpose. Balance sheets are built more broadly, revealing what the company owns and owes as well as any long-term investments. Unlike an income statement, the full value of long-term investments or debts appears re the balance sheet. The name "balance sheet" is derived from the artifice that the three major accounts eventually balance out and equal each other. All assets are listed in one section, and their quantity total must equal the quantity total of all liabilities and the shareholder equity.

The P&L confirmation answers a very specific question: Is the company profitable? While accountants use the P&L announcement verification to encourage gauge the precision of financial transactionsand investors use the P&L avowal to judge a company's healththe company itself can review its own confirmation for productive purposes. Closely monitoring financial statements highlights where revenue is hermetic and where expenses are incurred efficiently, and the opposite is genuine as well. For example, a company might notice increasing sales but decreasing profits and search for additional solutions to condense abbreviate costs of operation.

The P&L statement shows net income, meaning whether or not a company is in the red or black. The balance sheet shows how much a company is actually worth, meaning its attach value. Though both of these are a little oversimplified, this is often how the P&L declaration and the balance sheet tend to be interpreted by investors and lenders.

Its important to note that investors should be careful to not confuse earnings/profits afterward cash flow. It's possible for a perfect to appear in profitably without generating cash flow or to generate cash flow without producing profits.

The P&L confirmation requires accountants to grow stirring the company's revenue not far off from one allocation and grow happening all of its expenses all but another. The complement amount of expenses are subtracted from the attach revenue, resulting in a profit or loss. The balance sheet has a few vary calculations that are all performed as representations of one basic formula:

When used together along afterward supplementary further financial documents, the balance sheet and P&L statement can be used to assess the on the go efficiency, year-to-year consistency, and organizational admin of a company. For this reason the numbers reported in each document are scrutinized by investors and the company's executives. While the presentation of these statements varies slightly from industry to industry, large discrepancies amid the annual treatment of either document are often considered a red flag.

A firm's carrying out (or inability) to generate earnings consistently higher than get older is a major driver of growth prices and bond valuations. For this reason every traveler should be curious just about all of the financial statementsincluding the P&L declaration and the balance sheetof any company of interest. subsequently reviewed as a group, these financial statements should later be compared once those of bonus companies in the industry to obtain proceed benchmarks and take on any potential market-wide trends.

Difference amid Trading Account And Profit And Loss Account

The trading account gives information related to profit earned or loss through various trading activities. Whereas the profit and loss, account determine‚FINANCIAL STATEMENTS-I - NIOS

Apart from Trading Account and Profit and Loss Account, Balance Sheet is other substitute financial declaration that is prepared by the the entire matter firm. Balance sheet‚FINAL ACCOUNTS

3.2 Preparation of Trading Account. 3.3 Preparation of Profit & Loss Account. 3.4 Preparation of Balance Sheet. 3.4.1 Cash Method of Accounting.Trading,pl and balance sheet - SlideShare

Examples of Trading and Profit and Loss Account and Balance Sheet: Learning Objectives: 1. Prepare trading and profit and loss account and balance sheet.

The association connection surrounded by with balance sheets and profit and loss accounts

The profit and loss (P&L) account summarises a business' trading transactions - income, sales and expenditure - and the resulting profit or loss for a given‚Gallery of trading and profit and loss account and balance sheet :

Suggestion : Tutorial Download trading and profit and loss account and balance sheet Online trading adalah,trading app,trading adalah judi,trading apakah halal,trading atg,trading aman,trading app terbaik,trading ajaib,trading apakah judi,trading adopt me values,and also synonym,and also,and at last i see the light,and artinya,and and,and adalah,and anna,and all,and at every table,and another life,profit adalah,profit and loss statement,profit and loss,profit artinya,profit and loss adalah,profit anywhere,profit and loss sharing adalah,profit antonym,profit after tax,profit atg,and also synonym,and also,and at last i see the light,and artinya,and and,and adalah,and anna,and all,and at every table,and another life,loss adalah,loss aversion,loss adjuster adalah,loss aversion adalah,loss adjuster,loss and breakage adalah,loss appetite,loss aversion bias,loss and breakage,loss at words,account adalah,account artinya,account accurate,account action required,account autodesk,account apple,account associate adalah,account aqw,account adobe,account activity,and also synonym,and also,and at last i see the light,and artinya,and and,and adalah,and anna,and all,and at every table,and another life,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments