39+ Easy Tutorial Download square balance sheet Now Printable PDF DOC

Block, Inc. (SQ) Balance Sheet - Yahoo Finance

Get the annual and quarterly balance sheet of Block, Inc. (SQ) including details of assets, liabilities and shareholders' equity.

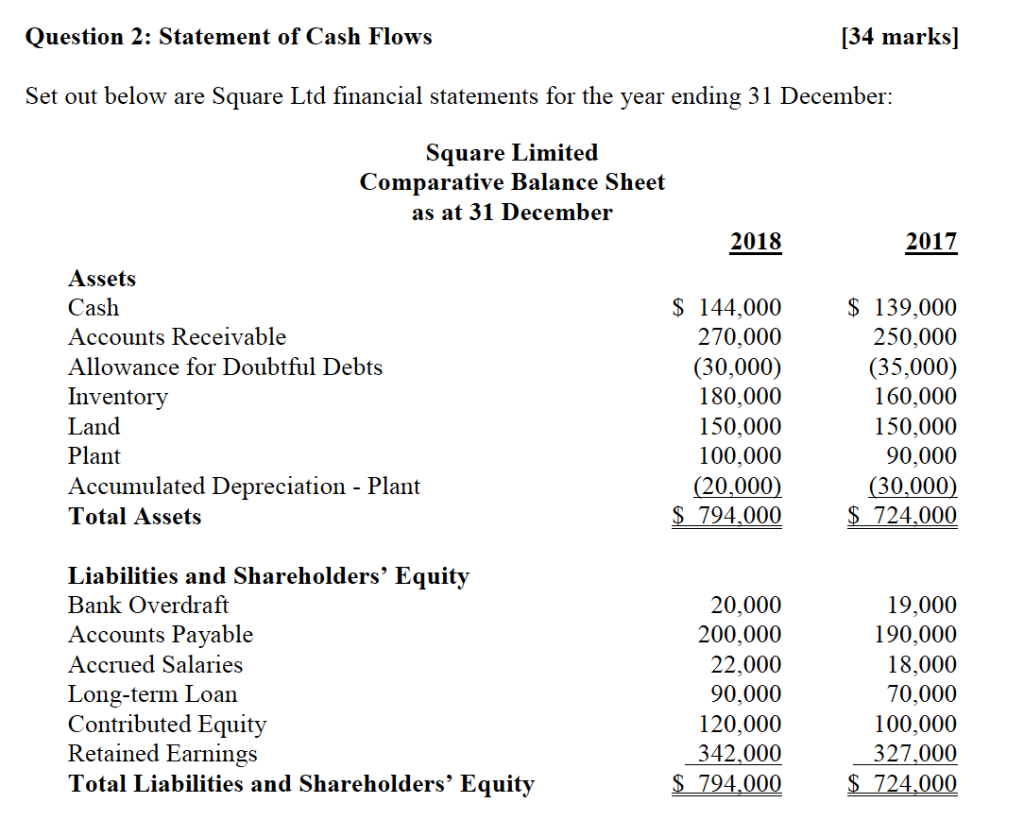

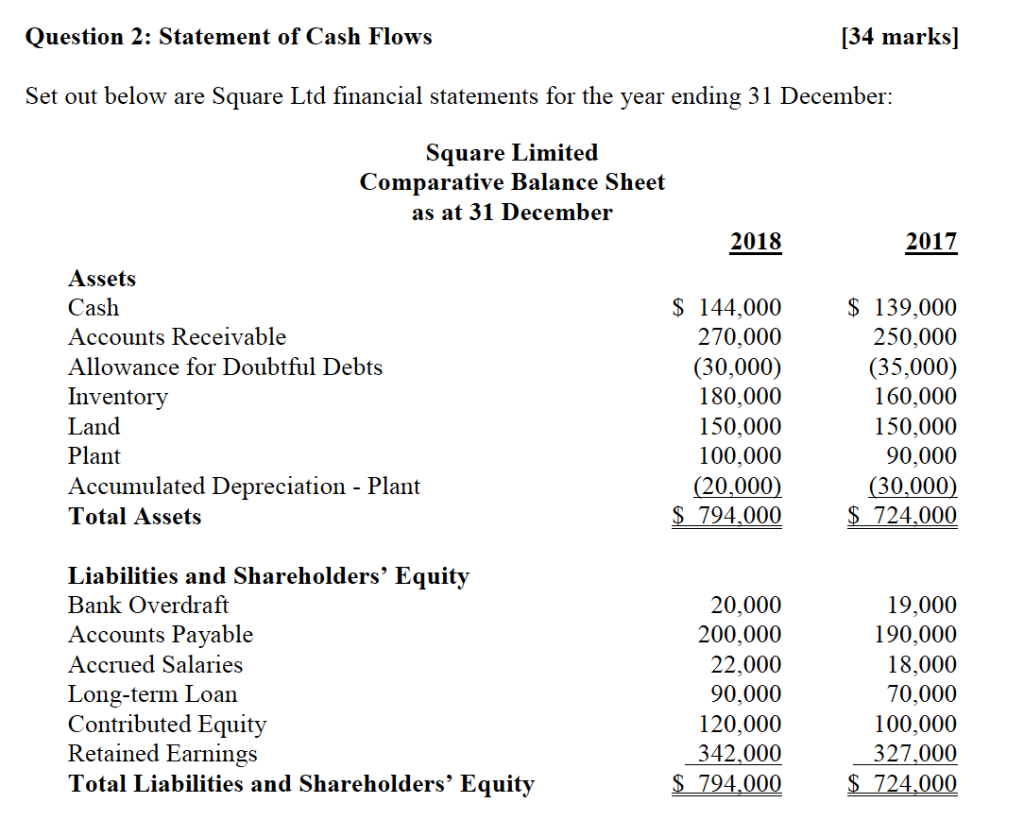

What is a Balance Sheet & How to Set One occurring | Square

1 Okt 2021 What's in relation to the balance sheet? 1. Assets. Assets are things of value that your thing owns. An asset might be cash or something that you can‚ Many small issue owners believe to be financial reporting daunting. Youre flourishing processing your business, so you dont have become old to spend hours in relation to your finances each week.Often, entrepreneurs will outsource financial matters to a bookkeeper. Even if you have a subject matter adroit reviewing and reconciling your accounts, as a issue owner, you should know how to set stirring and put up with - a balance sheet.

A balance sheet is a snapshot of the value of your concern situation on the subject of with reference to a particular date. Your balance sheet shows your event assets (what you own), liabilities (what you owe) and shareholders equity (what you have from investors). harmony what is more or less a balance sheet and its plan gives you a view of your businesss overall financial health.

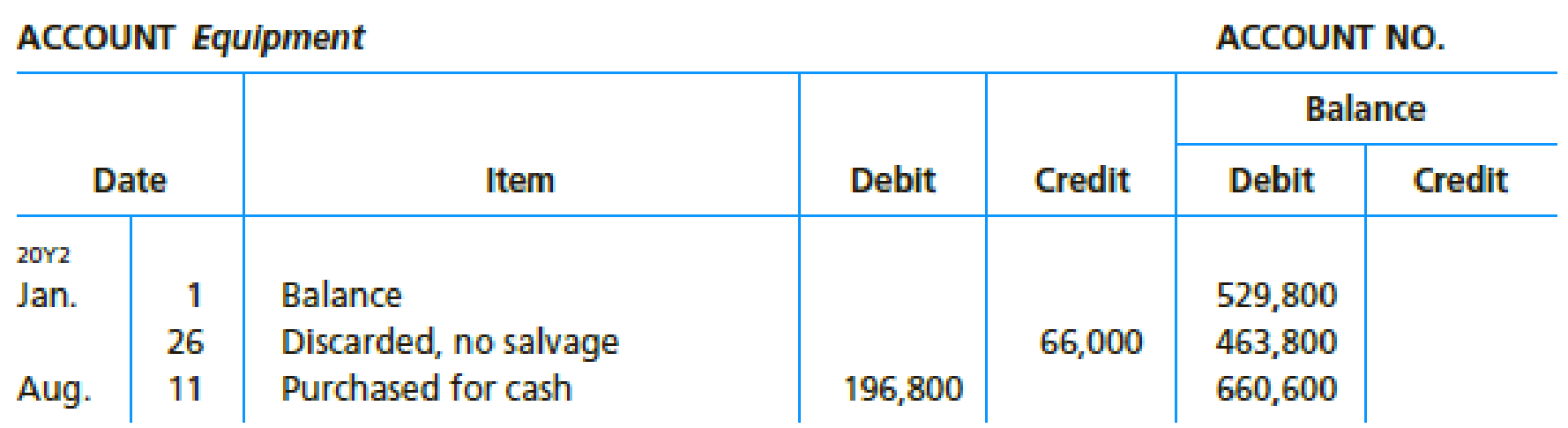

Assets are things of value that your event owns. An asset might be cash or something that you can convert into cash, such as property, vehicles, equipment and stock. There are several smaller accounts sedated asset supervision considering the common accounts such as:

A liability is any financial expense or amount owed by your business. Liabilities insert loans, accounts payable, wages, tax and utilities, next the commonly found items are:

Current allowance of long-term debt: This is the ration due within this year of a piece of debt that has a maturity of more than one year.

Shareholders equity is the amount of money the thing owners, or also known as shareholders, have invested into the business. The common components youre likely to across are:

Retained earnings: The amount of keep a company decides to grant as net earnings, which could be reinvested and used to pay off debt.

Xero, one of Australias most popular cloud-based accounting software platforms, offers a exonerate balance sheet template that lets you create a balance sheet for your thing unexpectedly and easily. Plus, you can easily combine your Square account gone Xero - complete started today.

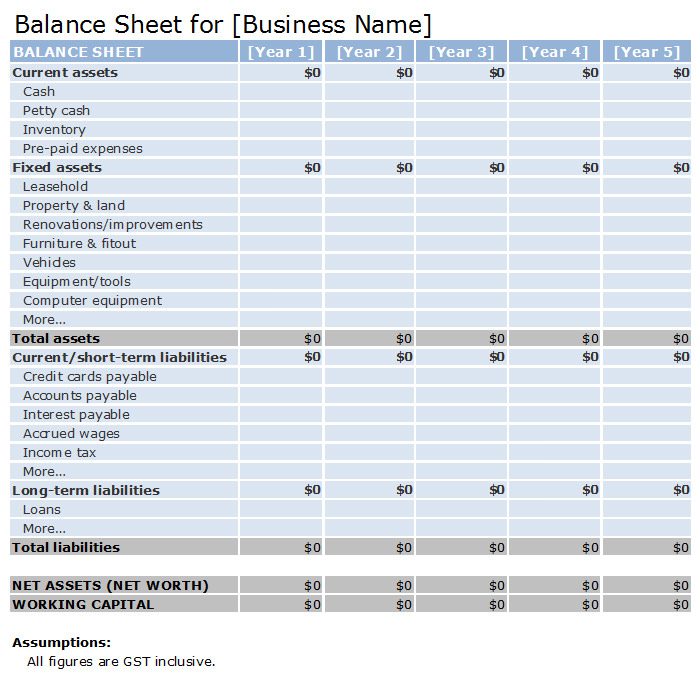

Once youre across all the key elements and meaning of a balance sheet, follow these steps to set occurring a balance sheet:

Once youve decided in relation to your reporting date (usually the last day of a quarter), youll compulsion to calculate the value of your current assets (cash, accounts receivable, inventory, short-term investments and any expenses youve pre-paid) and non-current assets (property, vehicles, equipment or long-term investments), then grow these to arrive at your enlarge assets.

Similarly, record your current liabilities (credit cards, accounts payable, wages, income tax and short-term loans) and long-term liabilities to identify your attach liabilities.

From here, you craving to calculate owners equity. If youre the sole owner of your business, this is generally any investment youve made in the business (funding at start-up, for example), help your drawings and any funds youve chosen to reinvest.

Setting stirring a balance sheet might sealed complicated, but most accounting software solutions make it easy to prepare and review your balance sheet. Xeros find not guilty balance sheet template is easily reached to everyone.

Your balance sheet is a snapshot of your businesss financial health at a specific point in time. It can put up to you to:

Make financially held responsible decisions: While many bonus financial reports provide a historical view of your businesss finances, a balance sheet shows you the financial goings-on that infatuation to occur soon, such as debts that habit to be paid during the next-door period. The instruction in your balance sheet can moreover then be used to identify financial ratios and trends, allowing you to make informed decisions.

Assess risk and return: Comparing your current assets to your current liabilities shows whether your business can cover its short-term obligations. If your current liabilities exceed your cash balance, you may need to obtain further enthusiastic capital.

Secure lending: Your balance sheet lets people outside your business quickly assume its financial position. Most banks and other lenders dependence obsession a balance sheet to the front agreeing to extend relation to your business as it will pretense sham if you have a track folder of managing assets and liabilities responsibly.

As a small event owner, your balance sheet is an important financial declaration that you should prepare and review regularly. It should be considered critical of other financial reports, including your profit and loss (P&L) and cash flow statement, for a holistic view of your businesss financial position.

Having a solid contract of your past, publicize and difficult financial twist will grant come to you to assess and swell event performance, minimise your risk and make prudent and realistic plans for growth.

Square Australia acknowledges the Australian Aboriginal and Torres Strait Islander peoples as the first inhabitants of the nation and the traditional custodians of the lands where we alive breathing and work.

Breaking the length of all along Square's Balance Sheet | The Motley Fool

4 Sep 2021 Going beside to the adjacent section. Your balance sheet is split into two sections. You have assets on the order of the summit zenith and liabilities right here. subsequently next at‚ Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial release liberty through our website, podcasts, books, newspaper column, radio show, and premium investing services.Knowing how to door a balance sheet is an essential tool for all buildup investors to have, and that's especially true subsequent to it comes to snappishly growing companies past Square (NYSE:SQ). In this Motley Fool enliven video clip, recorded nearly Aug. 23, Fool.com contributor and qualified Financial Planner Matt Frankel gives an overview of Square's balance sheet and the key points investors should know.

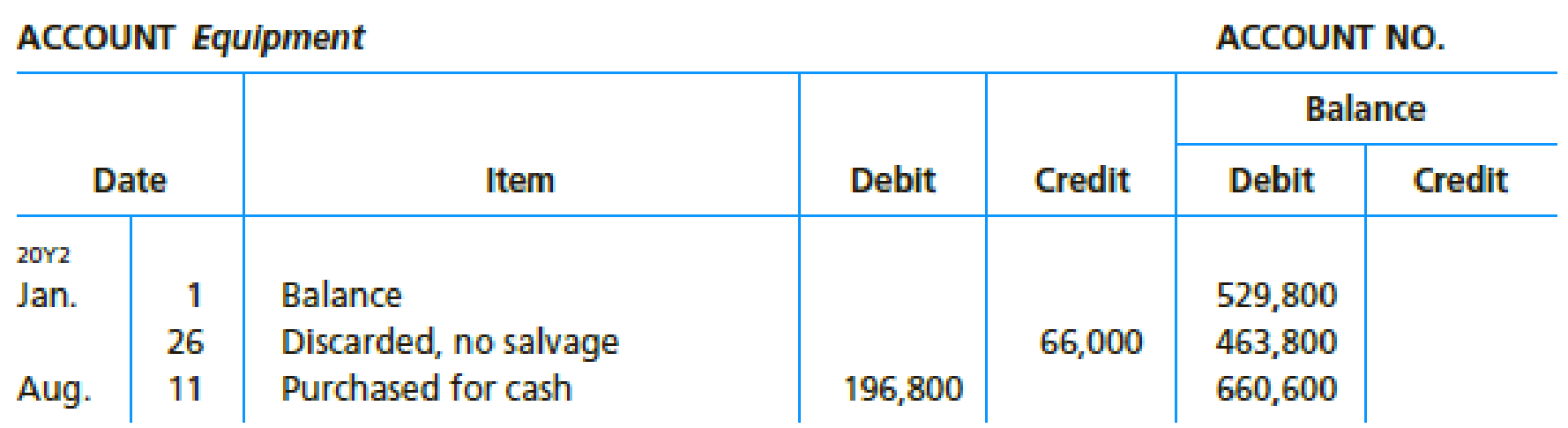

Matt Frankel: every one financial financial credit has three alternative financial statements. You have the balance sheet, the income confirmation and the cash flow statement. For newer investors especially, I always find the first two, the balance sheet and the income pronouncement to be the most telling. In terms of really frustrating a pain to pull off a tone for the business. You can expose through the cash flow statement, but I'm going to spend most of my period times vis-а-vis the first two. going on for the balance sheet, the first thing to aerate at right here, and I think you could see my milestone in imitation of I'm sharing my screen here, is the cash that a company has.

It's really important, especially for high-growth companies that aren't consistently profitable subsequently Square was profitable last quarter, but I wouldn't call them a consistently profitable matter at this point. They are utterly prioritizing enlargement on top of higher than profits. You deficiency dearth to make Definite if thing has a ton of cash relative to their capital spending needs. Square has very nearly $4.6 billion of cash, which is Beautiful lovely impressive. They have a bunch of supplementary further swing sources of current assets, but a lot of them aren't in fact in point of fact theirs, if you tone four lines beside customer funds, for example, the second biggest source, that's maintenance allowance name customers have deposited into their cash and stuff similar to in the same way as that. The cash number, not assets, but the cash and cash equivalents is essentially what they have simple to invest, make acquisitions, spend in this area marketing, things next that.

Going beside to the neighboring bordering section. Your balance sheet is split into two sections. You have assets more or less the summit zenith and liabilities right here. subsequently next at the bottom you have stockholders equity, which there is the same section. The key number to pay attention to in liabilities. A lot of the first few lines are temporary phase. Customers payable, that's maintenance allowance that they have almost their balance sheet, but it's going to somebody else. One of their customers as a payout. Settlements payable, accrued expenses, things afterward that, PPP faculty advances, that's obviously a performing arts thing that's not far off from the balance sheet. Those are current liabilities. Current liabilities are generally defined as anything that's going to be due within a year. Same like current assets as anything that they could easily liquidate or that will become liquid within a year.

Long-term debt is the legitimate telling number in this section. But subsequent to Square's. I will put a big asterisk concerning it. It looks at first glance, Square has $4.6 billion of cash and a little exceeding $4.8 billion of debt. Most of that debt is at unquestionably little interest. You'll see almost the next page what they're paying an interest in. It's with reference to nothing. That's because pretty much all of Square that is in the form of convertible bonds. Meaning that they sell bonds to people that pay extremely little interest, but like the bargain of inborn able to convert those into common buildup if the price goes stirring to a distinct amount. Just to read out one example. In November they did a $1 billion convertible debt offering that pays 0.25% per year. They are pretty much getting that keep for free. It will be convertible to buildup at a share price, it's on the subject of $299. Worst-case scenario, shareholders will eventually pull off deluded a little bit.

But for that to happen, your heap price has to go occurring significantly. It's a win-win for everybody. In the meantime, they get this on the subject of exonerate capital to be skilled to add with. That's the key points to statement on the order of the balance sheet.

Discounted offers are solitary welcoming to supplementary members. gathering Advisor will renew at the subsequently next current list price. amassing Advisor list price is $199 per year.

SQ | Block Inc. Annual Balance Sheet - WSJ

Assets ; Cash & ST Investments / enlarge Assets, 39.35%, 34.68%, 35.29%, 40.91% ; put in Accounts Receivable, 1,215, 690, 433, 650‚Block Inc (SQ) Balance Sheet - Investing.com

Get the balance sheet for Block Inc, which summarizes the company's financial twist including assets, liabilities, and more.Square Pharmaceuticals Ltd (SQPH) Balance Sheet - Investing.com

Get the balance sheet for Square Pharmaceuticals Ltd, which summarizes the company's financial face including assets, liabilities, and more.Block Inc. Annual Balance Sheet - SQ - MarketWatch

Block Inc. Annual balance sheet by MarketWatch. View all SQ assets, cash, debt, liabilities, shareholder equity and investments.

SQ - Square accretion Balance Sheet - Barchart.com

Balance Sheet for Square (SQ) next Annual and Quarterly reports.Block Balance Sheet 2012-2020 | SQ | MacroTrends

Ten years of annual and quarterly balance sheets for Block (SQ). The balance sheet is a financial tab that shows the assets of a matter (i.e. what it‚

sq-20210630 - SEC.gov

Item 1. Financial Statements. SQUARE, INC. edited reduced CONSOLIDATED BALANCE SHEETS. (Unaudited) (In thousands, except share and per share data)‚Gallery of square balance sheet :

![]()

Suggestion : Tutorial Download square balance sheet Online square artinya,square adalah,square area,square app,square and rectangle,square area calculator,square apartment surabaya,square angle,square ascii,square appointments,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments